Group-think is a problem in markets; so many smart people look at the same (pretty limited) set of information, so it’s easy to understand why many people come to similar conclusions. Sometimes, it pays to step back and get out of the noise and information flow, and to simply pay attention to the message of the market. Smaller cap stocks are flashing signs that suggest a breakout, and possibly even a strong trend leg up, could be just around the corner.

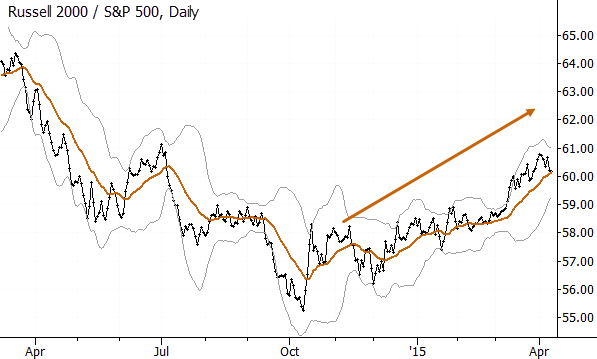

Everyone has been talking about small cap underperformance last year, but you don’t hear a lot of people pointing out that smaller-caps have been leading in recent month, and they’ve held together better on declines. When did this change? Just after the nasty October 2014 meltdown; curious to see an event like this lead to a regime change, but this seems to be what has happened. At any rate, smaller-caps have clearly been stronger recently:

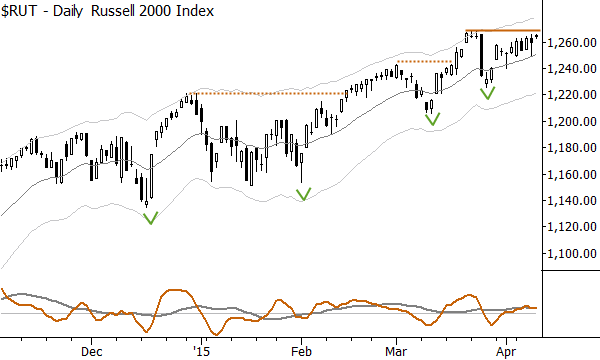

Next, let’s take a look at the market structure of the Russell 2000 Index. (We see similar factors in the S&P 500, but it probably makes sense to focus on the leading market cap slices.) First, we notice that every consolidation has broken to the upside; tune out all noise and quasi-news and speculation: this is what a bull market looks like. Stocks are in a strong bull market. Period. Yes, that will change, and we’ll cross that bridge when we come to it, but, for now, direction is clearly up.

There’s another factor here, too: pivot lows (marked with green “hats”) show a clear series of higher lows and higher swings pressing into resistance. This is another classic bull market pattern, as it shows that buyers are ready to step in on declines. Every time stocks sell off, ready buyers are willing to buy at ever-higher prices.

There are a number of other supporting factors, but the bottom line is that a number of tactical factors point up for stocks, and suggest that a breakout could be in the cards this week. It may be hard to reconcile this with a litany of concerns (e.g., soft labor market data, mixed earnings, concerns over crude, fears of Fed action, etc.), but remember, information like this always makes sense in hindsight. Where we must act, in the now, is far less certain, and fortune favors the bold (provided the bold can properly size positions and manage risk!)

Watch for a breakout this week. What’s your plan? What will you do?

Maybe a thought for the podcast…: you can easily avoid group think by simply not reading financial/economic analysis… it mostly works for me, life is much easier being ignorant. I am trying to follow very very few stocktwitters, definetely less than 10 and avoid all the noise – needs to have some advantage to have a day job outside finance and drowning in work and other personal commitments…But of course nobody is immune to this and there are other, less busy periods…

Actually your work serves apart from all deep insight also as “entertainment” helping to avoid doing stupid things out of boredom.

Thank you! I used this in my podcast. Good perspective.

Please Do Enlighten us (via any of Your Communique) on Your Reference to the different concepts of ‘Regime change’

I think that’s a whole series of ideas… I’ll think about how to talk about this more, because it is important.

Thank You ! Your Perspective on this Subject is truly Valuable; will wait for it….. Thank You for all Your Help.

poised for a breakout??what the heck are you talking about . the markets been breaking out since 2009.nothing but one big fake rally.if you’re holding cash be patient and buy after the crash. trust me its coming only a matter of time.

Thank you for this comment. I used it in my podcast. I might gently suggest… the market has rallied, roughly 150% from the 2009 lows, and this is one of the five (or fewer) great bull markets of all time. If that’s a fake rally, so be it, but your trading and investing plan should probably include some way to get into this kind of “fake rally”.

This is Hong Kong Hang Seng Index.

Most charts appear to have obvious S/R levels, but that appearance does not mean they are real. This is worth a few minutes of your time: https://www.youtube.com/watch?v=5mPp7_fajvo