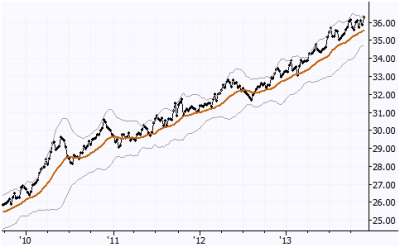

Chart of the Day: XLY/SPY Spread

Do you trade spreads? If not, you might ask yourself why not. This is a longer-term chart of the performance of Consumer Discretionary stocks (XLY) relative to the broad market (S&P 500, SPY). A few points: trends in spreads can persist for many years, and can be much easier to trade than patterns in outright markets. This particular spread may also be a way to gauge the underlying sentiment or psychology behind the market—rather than wonder about each headline or each shifting pundit who explains why stocks can't go higher, it's much easier to monitor the performance of cyclical stocks relative to broad market. As long as that leadership is intact, the smartest bets (for the intermediate term) will be placed with the prevailing trend. When something changes, and it eventually will, this spread will probably be the proverbial canary in the coal mine: a shift here could warn of (or confirm) an impending market breakdown. If you don't already trade and track spreads, consider doing so. This can be a valuable addition to the trader's toolbox.

We will cover spreads in a later week of my free trading course.