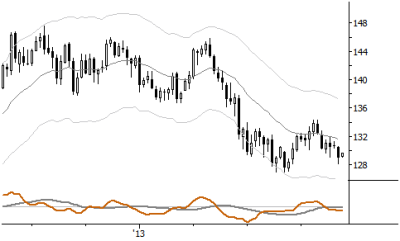

Chart of the Day: Stops on Treasuries

The chart of the 30 Year Treasury futures shows an important formation. First, we are short Treasuries, (in my published research) and have been for a while; the trade has performed moderately well, though we haven't really seen any sharp downside momentum. That's ok—some trades do drift and grind in the intended trade direction, but there is also a danger here. When you enter a position and the market drifts, even if it is in the trade direction, there is additional risk of a sharp move against the position should the trade fail. This is why sometimes I will say "use tight stops" or perhaps "use correct stops" for a trade like this. If you're short 30 Years, there's no need to hold swing shorts much above 132, and you could perhaps even use tighter stops than that.

One of the keys to effective trading is knowing the difference between a tight and a loose stop, knowing when to use one or the other, and knowing why. (Hint: the common answer "it's a low-risk trade" is the wrong answer, in my opinion.) This "drifting" tactical situation in Treasuries is one that justifies the use of a fairly aggressively tight stop to limit risk on open positions.