This post is the first in a series I will be extending for a week or two, focusing on short-term and intraday trading. Each day, I will be publishing a chart of the day that focuses on the best short-term ideas and setups I see in the US stock index futures. (I will use ES, but these ideas are equally applicable to YM, NQ, etc.) I’ll usually post this right around the US market open (9:30 EDT), but today’s is a bit late to start!

I will also write a series of articles looking at some of the short-term tendencies in markets, as well as some posts that look at the psychological challenges of short-term trading. Much of my work and writing has focused on swing trading, which reflects my personality and a conscious decision to shift to longer timeframes–I spent many years daytrading stocks, stock index futures, currency futures, so, in some ways, these next few weeks will feel like coming full circle for me! I’m excited to share these ideas and perspectives with you.

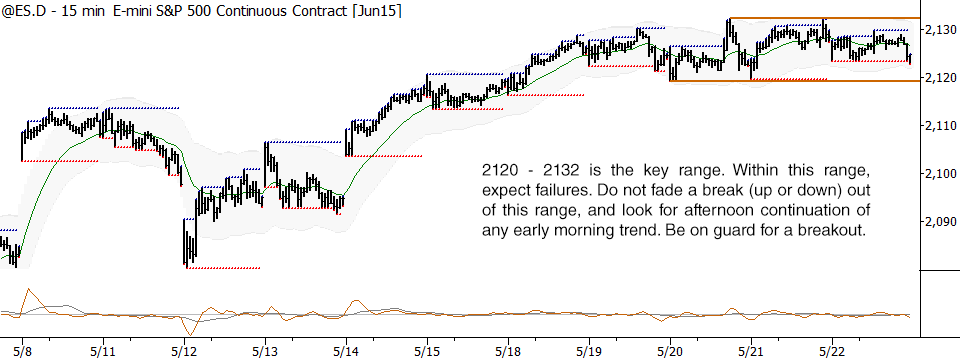

- Probabilities favor an upside break, but any break (up or down) could see continuation. Do not fade a breakout of the key 2120 – 2132 range.

- Especially powerful could be a gap opening (following the US Holiday) that does not reverse much in the first hour of trading. Setup from a sharp opening shock is for a clean trend day.

- Expect afternoon continuation of any early morning trend.

Hi Adam, does volume enter into your work short term? Does the lack of volume at new trading highs signal short term exhaustion?

I don’t use volume in my work in any capacity at all, Alan. I have never been able to verify an edge, nor have I found anyone who has done so. In fact, every time I write that I get notes from experienced traders saying something like “we did the same work on volume and could not find an edge”

Yet another traditional TA element that is taught in books and certification courses… that seems to lack any verifiable edge.

Adam,

Thank you for this great example.

Did you generate these ideas and scenarios from a pure objective technical reasoning process?

Did you consciously or subconsciously(intuition) add other considerations such as the whole market sentiment/fundamental in your reasoning?

You envisioned these scenarios with high confidence. But I always cannot help to think about (or fear) a failed breakout.

Well, don’t fear a failed trade… manage it. (that’s actually good advice lol… I just tweeted it)

These scenarios are the intersection of my 20 years of experience with my statistical work… so there’s a strong “street smarts”/discretionary component.

Thanks for the question!

Hi Adam, thank you for the trading course, your blog, and now sharing your analyses! My question is, do you consider unfilled gaps when working with the ES? Greetings!

hi. I think most of the work on unfilled gaps does not carefully separate what is random and what is not. I’ve never seen any actual tendency for gap fill that is non-random (i.e., statistically verifiable). Maybe it’s there, but I’ve looked at it and can’t find it. Visually, you see it on charts, but the eye finds patterns and even random walks cross the same point often. Gaps are just prices that are going to be touched with random motion, so, no, I think this is another way that tradition TA may be misleading.

(People will disagree vehemently with what I just wrote. Ask them to show you a proper test with a significance test.)

It looks like you are using only day session data. If you had an open position overnight, would you place a STOP order during night session or just leave it alone overnight?

Well, these are setups for the intraday trader… that trader might sometimes hold overnight, but then do have some risk management issues. In general, working actual stops in “overnight” markets is not a great idea because of liquidity concerns, but you do need to consider the risk.

If you’re looking at overnight holds (and, as I’ve said, I think most traders should focus on multiple day setups rather than intraday), then risk management is a critical issue to consider.

So, you think it is fine to hold an open position overnight without a STOP order. Taking DXM5 futures contract for example, it is normally less volatile after 14:00. On 18 March, 2015, DXM5 became extremely volatile after 14:00. On the next morning, it seemed nothing had happened last night. In this particular case, not having any STOP order overnight might yield a better result, as long as you had enough margin to survive through that extreme market condition. But in other cases, you might not be so lucky. It’s all about probability. No matter how we choose to handle overnight open positions may all be a reasonable choice.