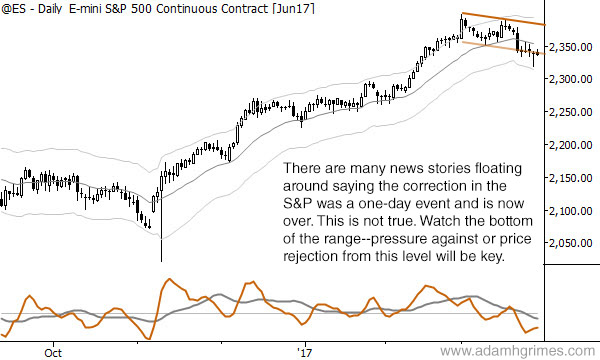

Chart of the day: is the “correction” in the S&P 500 over?

- Post author:AdamHGrimes

- Post published:03/28/2017

- Post category:Chart of the Day

AdamHGrimes

Adam Grimes has over two decades of experience in the industry as a trader, analyst and system developer. The author of a best-selling trading book, he has traded for his own account, for a top prop firm, and spent several years at the New York Mercantile Exchange. He focuses on the intersection of quantitative analysis and discretionary trading, and has a talent for teaching and helping traders find their own way in the market.

You Might Also Like

This Post Has 4 Comments

Comments are closed.

Pretty weak rallies from the lower projected flag line

Nice long tail yesterday, maybe a little bit of gas still left in the tank. Hope this comment doesn’t sound foolish three days from now.

Every time there is a pullback or correction in the market I always ask myself the same question, “what should I do”? If I don’t have any open positions I would normally just sit it out because my P&L tells me I’m terrible at shorting. So last year I started studying FX to add some depth to what I trade in pull back times or a down market. The problem is its been a year, I’m just about to finish off my first FX account (small account, not a problem) and I still can’t figure it out. Sometimes I feel that the FX market is so big that any edge must be diluted out. Anyways, I’m just fishing for some advise or ideas for trading through a down equities market. Thanks

Watch Rayner Teo’s videos on youtube. You will get good grasp on the way FX moves. They have been very helpful to me.