We all focus a lot of attention, perhaps too much attention, on where to buy and sell a market, on where to enter trades. Today, let’s spend some time looking at the other side: where are you getting out?

Some categories are useful here, and they are not complicated. First, we have exiting at a loss, or at a profit. (This is not necessarily the same as saying exiting on a stop or at a profit, because a (trailing) stop can often be a profit-taking technique.) Both of these can then be divided into two more categories: Exiting at the initial loss or a reduced loss, and Profit taking against a stop or at a limit. Let’s spend a few moments thinking about each of these.

Initial stops

The most important think about initial stops is that you have one. Though so many trading axioms and sayings do not apply universally, one that does is “know where you’re getting out before you get in.” For every trade, you should have a clearly defined maximum loss, and you should work hard to make sure that loss is never exceeded. In practice, bad things will happen. You will have the (hopefully rare) experience of a nasty gap beyond your stop, and sometimes will see losses that are whole number multiples of your initial trade risk. (I remember one lovely -4.5x loss in YHOO years ago. Though these events are rare, they are also a good reminder of we do not, for instance, risk 10% of our accounts on a trade. A 45% loss on a single trade would be a disaster, but 4.5x a reasonable risk (1% – 2%) is merely annoying.)

Initial stop placement is an art in itself, but, in general, I think too much of the material on the internet probably uses stops that are too tight. I’ve never seen anyone trade successfully with stops that are a few ticks wide. For me, initial stops usually end up somewhere around 3-4 ATRs from the entry. These stops are wide enough that many traders find them uncomfortable, but simply reducing position size to manage the nominal loss is an obvious solution. Taking losses is perhaps the most important thing you will do as a trader, so do it well and do it properly.

Reduced stops

We have defined that initial “never to be exceeded” (ideally) stop at trade entry, but many traders find it effective to move that stop rather quickly. Another possibility to consider is the time stop, in which we take steps to limit the position risk if the trade does not move in some defined time. There are many possibilities here, ranging from tightening the stop, to reducing the position, to exiting completely.

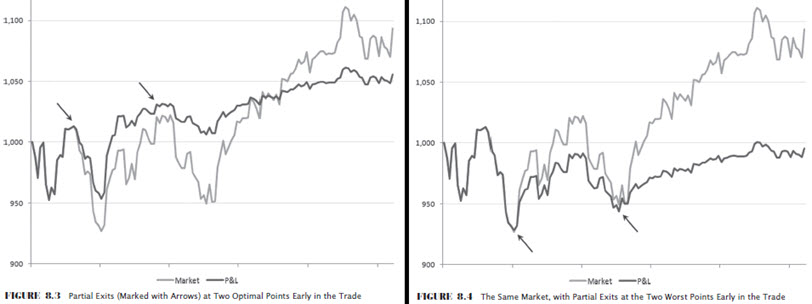

I have made a good case for not reducing the position at a loss because it effectively “deleverages” your P&L in the “loss space.” (See the chart above, which is drawn from pages 242 and 243 of my book.) Personally, I’ve found that simply taking whole, but smaller than initial, losses is more effective, but your experience may be different. A key point here is that all of this–entry, exit, position size, moving stops, taking targets, re entries, adding to positions, partial exits, etc.–all of this must work together. You change one piece, and the whole system will change. This is why some techniques may be effective in some settings but not in others.

To simplify, think of reduced stops as being moved when the trade does not immediately go far enough in your favor, and consider the use of time stops.

Profit targets

Profit targets are usually limit orders, as opposed to stops (which, not surprisingly, are usually stop orders.) In general, I find that it makes sense to have profit taking limit orders working in 24 hour markets, though we may not wish to work stops in the same after hours environments. People sometimes make mistakes or do silly things in afterhours, and I’m always happy to provide liquidity at the right prices. 🙂

There is a school of thought that says that all trades should simply be exited at profit targets, while there is a conflicting school that says we must let our winners run. How to reconcile these two approaches? I think the answer lies in trading style. For trend traders, we must let our profits run. As countertrend traders, we must take quick profits, usually at pre-defined areas. I have not found chart patterns or points to be any more effective than simply setting a target 1X my initial risk on the “other side” of the entry. Many people like to use pivots or trendlines, but I’ve executed well tens of thousands of trades (one of the advantages of spending years as short-term trader) and have simply not found these to be that effective. (For intraday traders, highs and lows of the day do deserve respect.) Consider the tradeoffs in simplifying your approach.

Trailing stops

Trailing stops can be managed in many ways, and I have found these to be very effective in many types of trading. We can trail at some volatility-adjusted measure, and there are even times we trail a very tight stop, effectively hoping to be taken out of the trade. This is a good problem to have: sometimes you may trail a stop at yesterday’s low, and be shocked as the trade grinds in your favor week after week–there’s nothing to be done in these cases but be forced to stay in the trade and make more money, but guard against hubris: many of the times this has happened to me I have been properly positioned into a climax move. When these moves end, they often end dramatically, so simply ring the register and step away from the market.

Putting it all together

This is certainly not an exhaustive list of all the possible ways to exit trades, but it will get you started in the right direction. I find that combining these techniques, using a pre-defined target for part of the trade, trailing the stop on the rest, and moving quickly to reduce initial risk on my rather wide initial stops, this works very well for swing trading the markets I follow. (If you want to see me do this in real time, I invite you take a free trial of the research I write for Waverly Advisors ever day.)

Consistency certainly matters, but consistently doing something that works will, not surprisingly, lead to consistently losing money. Make sure you have a well-designed system with an edge, and that the system is one you can follow in actual trading. Make sure you trade with appropriate size and risk, and that you monitor your performance accordingly. With these guidelines, you can be a few steps closer to developing your own system and approach to trading.

Good article. I’m paraphrasing but you said you haven’t found any patterns or chart points to be any more effective then setting a target 1X your initial risk. Do you consider ‘measured move’ a pattern? If so, does the measured move have an edge for profit taking?

I think the measured move is a reasonable extrapolation of current volatility, measuring that volatility as a length of swing. In that sense, yes there probably is some sense. At the very least it tells you if your target should be 0.25, 25, or 250.

(Writing this comment I am more on a Kahneman’s System 1 mode, so sorry if there’s a logic mistake. But you know.. I have a System 2, too.)

Every time I notice an asymmetry, a flag is raised and it grabs my attention because usually the premises are false and the asymmetry shouldn’t exist, but sometimes there can be something interesting/worth investigating/more profound about the nature of the problem justifying that asymmetry.

So.. partial profits are desirable, but partial losses – not. I don’t think I understand why there should be a different approach here.

If I am not wrong, over a large number of trades, the only benefit of automatic, predefined, without-known-edge partial profits (let’s say 50% of the position at 1X), is that the evolution of the portfolio will be smoother, more or less you will end up with the same amount of money, but with less volatility.

I don’t see why we can’t (or we don’t want to) get the same effect by taking partial losses. I don’t understand the chart above. Of course that if we sell at the worst possible moment, we experience some avoidable losses, but when I do an automatic partial sell at a loss, I don’t know that the market will rebound (just like with the partial profit, I have no idea if the market will move against me or in my favor).

A few thoughts:

First… good comment and good thoughts. I agree with much of what you’ve written here.

I think one factor is the predictive “power” (magnitude and duration) of patterns. No one would expect a 2 bar pattern should have predictive power 100 bars out, so it makes sense to somewhat tailor the stop and target to the range over which we would expect the trigger to tilt probabilities.

And… I very much share your suspicion of asymmetry. It’s always a point for careful thinking. In this case, don’t we greatly desire a asymmetrical outcome? That’s the key… we don’t want our P&L to have a 0.0 mean. 🙂

I’m not sure that’s the ultimate answer, but it might be the answer to the asymmetry question.

In general do you manage a trade if it is not acting well right after entry? Say you enter a pullback trade breaking out of a lower time frame consolidation thinking you have identified a tipping point entry but there is no follow through and that bar or the following bar closes against you but it has not hit your stop.

One of the hardest things I find is trying to balance minimising loses if the scenario I was looking for is not playing out vs. avoiding the noise and randomness.

I tend toward hands off…. giving things a little more time and room, within limits.

Adam, I am curious how a veteran trader like you manages a stop in real time. Lets say you put a stop far away and in a couple of days the market gaps down and hits your stop level intra day. Do you just exit at that point ? or do you wait for it to actually close below your stop and then exit sometime towards the close ? The downside with this approach is by the close the price could have gone well beyond your close.

There are times you might want to work stops on close only, but I would work initial stops intraday… that will avoid greater than 1R losses.

Pingback: Dash of Insight| Weighing the Week Ahead: Is the Fed Too Optimistic?

Pingback: Weighing The Week Ahead: Is The Fed Too Optimistic? | Stock Market News

Pingback: Weighing The Week Ahead: Is The Fed Too Optimistic? | InvestingLab.com

Pingback: Weighing The Week Ahead: Is The Fed Too Optimistic? | OptionFN

Pingback: Is Fed Too Optimistic? - TradingGods.net

Pingback: 5 Great Trading Articles: 4/10/16 - New Trader U -