Reader question: what's wrong with Fibonacci?

Matt asked a question that I sat on for quite a while. I wasn't sure how to write a reasonably concise answer to a good question, but I'll try today. First, the question:

I see you don't believe in Fibonacci ratios, but it seems every book and website says they are really important. I read your analysis on your website and it was convincing, but your stance is so different to the CTA program and all the other technical people out there. You've shared stories of your development as a trader and I was wondering Could you maybe talk a little bit more about how you came to the conclusions you have? Maybe seeing the path you walked will help me find more confidence to stand apart from the Fibonacci crowd. Could you tell me what's wrong with Fibonacci and even more how you came to believe this?

Thought-provoking question, and one that deserves a good answer. First of all, I'm assuming if you are reading this you understand how Fibonacci is applied to trading. At a bare minimum, you should understand retracement ratios, extension ratios, and time ratios. If you are fuzzy on that, just google it (I just opened another tab and my first search found 11.8 million hits) and familiarize yourself with the common practice in today's technical analysis. As a very short summary, there are two issues here to consider: First, many people believe that the so-called "Golden Ratio" (a number that begins with 1.618) describes many important relationships in the universe and human art. Second, people note that this ratio can be derived from the so-called "Fibonacci sequence" {0, 1, 1, 2, 3, 5, 8, ...} and further assume that the actual numbers have significance themselves--i.e., that the number 13, because it is a Fibonacci number, might have some special qualities that 12 and 14 do not. These ideas are extended to financial markets, usually in measuring length and magnitude of a market's movements in time and price, or in some relation.

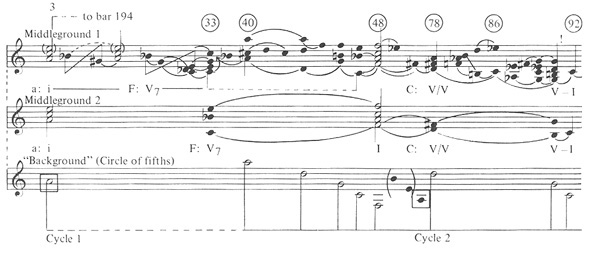

I don't know when I first encountered Fibonacci numbers. I was interested and curious about various arcane schools of thought even as a kid, so I'm sure I had some encounters with the idea before I reached high school. My first serious investigation came in college as I was working on a degree in music composition. Part of the process of learning to write music is learning what people have done before you, and there are various schools of thought about how to understand and analyze a composer's work. I was working with a technique called Schenkerian Analysis that basically takes a piece of music and reduces it to a few key elements--a way to see the skeleton of the body or the frame of the building. In reading the works of other analysts, I found that people said the Golden Ratio was very important in the structure of many pieces. I probably looked at 100 examples, and then launched into deep analysis myself.

I'll spare you the gory details, for I spent many months on this project. At first, I was excited because I had unlocked some key to the mysteries of the universe. If I could understand the use of this ratio, then I could improve my own compositions. I could probably use the idea in the computer-generated compositions I was working on, and maybe could develop some alternate tuning systems that would take advantage of different ratios of resonances. What I discovered early on was that the Golden Ratio did not "work". Sometimes important things fell near the ratio, sometimes (quite rarely) exactly on, but often not at all. There were also inexplicable things, such as very important features coming at some other ratios, while some very minor detail hit a precise Fibonacci ratio--and "pro-Fibonacci" people would call that a win. I scratched my head; maybe there was something I didn't understand, but it seemed like hanging a work of art on a wall and then marveling over some detail of how the floor tiles hit the wall--probably simply due to chance, and almost certainly not significant.

I then encountered the "measurement issue": when I talked to people who were supposed to be experts, they were extremely evasive. I remember a conversation with someone who had written an influential book. When I explained that I could not make the ratio work in a specific Beethoven piano sonata, he told me that was because I needed to measure ratios in space on the page; in other words, inches. This, of course, is nonsense. Our perception of music is ordered in time, not physical space. Physical space on a page is arbitrary; I found examples of the same sonata in different editions that were 4 or 20 pages long, and things were spaced proportionally very differently in those different editions. I discovered something that I would later encounter in trading: people would use whatever measurement system they needed to make the theory fit the facts. Once I looked at the problem objectively, I saw that "big things" tended to happen later in a piece of music rather than earlier, usually after the middle and somewhere quite a bit before the end. This, of course, is a dramatic pattern that makes sense in a book, a play, a film, or pretty much any other structure--it's just common sense. But the idea that 61.8% was some magical ratio in music--that just didn't hold water. When I started digging into relationships between ratios and musical notes, that didn't really "work" either. So, after many months of intensive work, I decided that Fibonacci ratios in music were overhyped and simply didn't represent reality in any meaningful way. Did it make more sense that composers (who, in most cases, were writing music for a living because it was their job) would follow a formula of "big thing happening somewhere after the middle and near the end", adapting it to the flow of whatever piece they were writing, or that someone was staying awake at night trying to hide a secret code of the universe somewhere in between the notes?

Fast forward a few years to where I was learning to trade. I'd had some successes and failures, and realized that I was going to have to study very hard to make this work. I tracked down a bunch of original source material from legends like Schabacker, Gann, and Elliott, as well as a big selection of the modern books written on the subject. In the beginning, I quickly forgot the Fibonacci lessons I learned in music, and was awed by the power of the ratios in financial markets. I read book after book talking about the different ratios and how they described moves, where to put stops, where to put targets, when to predict turns--I saw it worked often. Of course, there were cases where it did not work, but there was also this strong appeal to mysticism in much of the writing: these are "sacred ratios" upon which the "foundation of the universe rests". How could I ignore such portentous information when I was entering a trade on a currency chart?

A few things eventually shook my belief in the concept. These are, perhaps, best told in bullet points:

- You couldn't be sure which level would work, but some level always worked after the fact. I began to realize that levels would be violated in live trades; I had dutifully placed my stop a few ticks beyond, but then another level clearly held at the end of the day. There was no way, and no way in the literature, to predict which level would hold. Once I learned about the idea of confluence (see chart above), I realized that we were drawing so many levels on charts that it might just be luck that they seemed to work.

- I began to understand randomness. I had a weird formal education. My quantitative training in undergrad was sorely lacking. While I would not recommend this to anyone, it did leave me with a curious hole to fill: I had to re-think the problem of randomness from the ground up, as I did not have a good understanding of things like confidence intervals and significance tests. From practical trading, I saw that there was a lot of noise in data, but I wasn't sure how to tease it out. As I was getting a better education, I came up with a stop-gap; I generated many charts of random market data according to various techniques and spent a lot of time looking at them. If I had a better formal education I probably would have thought this was a waste of time, but I experienced so many cognitive errors as I did this. It's one thing to know them academically, but when you see how easily your perception is swayed and how easily you find patterns in random data, you start to think deeply. Does it invalidate the idea of patterns in real market data? Of course not, but it certainly challenges the claims of "just look at a chart! You can see it works! How can you question it? Look at these examples..." Armed with that first hand experience (and, again that word is critical--it was experiential, not academic knowledge) I became very critical of examples and claims.

- I did some background work on the people making claims for the tools. I won't dwell on this because I don't think it's constructive, but suffice it to say that someone could make a good career out of debunking Fibonacci experts, just like Houdini did with mediums in his day. I realized that we have a tendency to put some aura of greatness around past gurus, who, in many cases, were part time traders who had poor access to data and no analytical tools. Alexander Elder, in his excellent book tells of interviewing the great W.D. Gann's grandson, and that his grandson said there was no fortune and no profits from his trading in the stock market. When I dug into the current gurus on the internet, I discovered that many trades were done at improbable prices ("How do you always get filled on the bid every time?"), and, years later, one of the big gurus from the early 2000's told me that all her trading, scalping NQ futures, was on a simulator and she never had a live trading account. Sadly, I had seen hundreds of people try to replicate her methods, with no success. I could go on and on. I wasn't trying to tear down any idols; rather, I was desperately searching for some evidence that someone was really applying these tools to make money.

- The last straw was adjusted price charts. This might seem odd to newer traders, but when you look at past price charts, those prices may or may not represent prices at which the asset actually traded. Much of the discipline of technical analysis rests on the idea that people have a memory around specific prices. While this may or may not be true, there are different ways that historical charts must be adjusted. With futures, there are at least three common methods (difference, ratio, or unadjusted), and the question of when to roll to new contracts. With stocks, there are issues of dividends, splits, spinoffs, and other corporate actions that may or may not be accounted for on the price charts. You still see this today: ask someone showing a Fibonacci extension on a crude oil chart how their chart is back-adjusted. How many days open interest or volume to roll? How does your chart compare to spot prices? The answer I got from asking many people was either confusion or "it doesn't matter." (I have seen this dismissal over the years from many people who use levels in various capacities. I remember explaining to a stock trader who had traded from more than 20 years why SPY prices were so different today from yesterday--in 20 years of using "levels" he had never accounted for dividends.) Simple logic here: if I tell you I have some powerful pills, but it doesn't matter which pills you take, how much you take--take 1 or 20, or when you take them, is it more likely that it magical medicine or that it does nothing at all?

- The whole thing died, for me, when I realized that it rested on vague appeals to authority. I knew this all along, but once I had been around the block a few times, it was even more obvious. The Emperor had no clothes. No one will ever provide you with a quantitative proof of Fibonacci levels working. (I've made this challenge many times, and I will renew it here. Show me something good and I will publish it and admit I'm wrong. Show me something possibly flawed but still substantial, and I'll publish it for discussion. It's possible my thinking on this subject is wrong, and I would love to expand my thinking in another direction. Despite me having said this hundreds of times, I have yet to receive a single shred of actual work done on these ratios.) The last apology for ratios I read was a few weeks ago when someone said that you could just look at charts and see they worked and a lot of his friends, who were medical doctors, said Fibonacci ratios were really important in the body and in art.

So, that's my journey, and that's why I place no emphasis at all on Fibonacci levels. Here's the real key: you do not need them. That's the point. It's not that I'm trying to tear down anything or simply show you that something doesn't work; it's that I'm showing you that this is probably confusing baggage and noise, and does not add any real power to your analysis. Why not focus your attention on things that do work?

Your answers may be different from mine, but that's my journey and that's why I don't use these tools in my trading in any capacity. If you want to dig deeper, I published some of my quantitative work on Fibonacci levels in the posts below. No, this is not, nor is it intended to be, a disproof of the theory, but it does offer a simple replacement that is supported by the data: look for retracements to end at about 50% of the previous swing, with a very large margin of error. We might wish for more precision, but that is all I have been able to find in the data. Good news, though: it's enough.

- Start here for background, and click the links for some basic numerical literacy

- I share some of my efforts to quantify the ratios in this post.

- This post and this post share some results from a deep look at a lot of market data.