Using context to refine an entry in the EURUSD

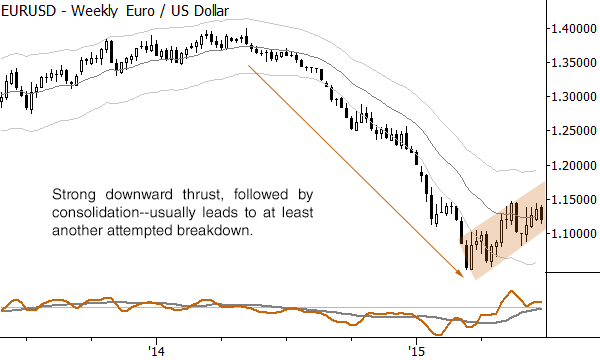

The EUR/USD provides a good example of how we can use higher timeframe context to motivate an entry based on a lower timeframe breakout. First, the big(ger) picture, from the weekly chart:

Reading market structure is important, and it's not that hard to do, with only a little experience. There are two principles at work here:

- The market tends to alternate between trending and ranging activity. After a period of ranging activity, be on guard for another trend. (Volatility compression at work.)

- Strong thrust tend to lead to another strong thrust; momentum begets momentum. In the absence of contradictory factors (e.g., exhaustion), look for another thrust following a sharp thrust on any timeframe.

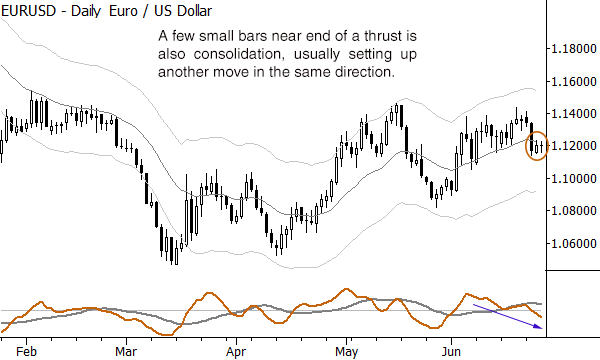

With that context, it's pretty clear that another leg down could be setting up in the EURUSD. Now, look at the daily chart:

Really, the same idea is at work here. Look at the last three bars: a strong down move, followed by two smaller bars. Those smaller bars hold near the low of the previous downthrust, suggesting that they are quite likely functioning as a consolidation. (To further confuse things, this daily chart is, itself, a higher timeframe expression of what is happening on an intraday chart.)

We can confuse and complicate this analysis as much as we want to, but we don't need to. These simple principles can guide our market actions. Context can give us constructive bias (which must be managed appropriately, just like a trade), which can point the way to some profitable trades.

There are other questions: how do you actually get in. (Answer: we don't really care. Check out my comments on this in my most recent podcast.) Where do you get out if you're wrong? Where do you get out if you're right? These are questions that are probably more important than where to get in, but having market context like this, and knowing what we expect to see if the context plays out as we anticipate--this can be powerful information. It's a lot easier to make money when we are aligned with the tendencies and flows in the market, and market structure points the way.