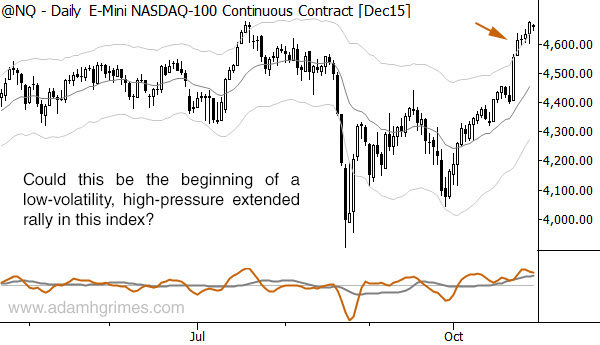

The beginning of another trend in Nasdaq stocks?

A few months ago I wrote a post on a certain kind of trending pattern I have called "slide along the bands." This pattern is characterized by a market that pushes into either the upper or lower Keltner channel, and trends against that channel with relatively few pullbacks. This is a rare, but important pattern to understand.

This is essentially a stead-state trend with no corrections, and it is dangerous if we don't understand the pattern. The market appears to be quiet, and many measures of volatility (e.g., ATR) may contract while the market is trending. This volatility contraction is potentially deceptive because these trends, when they stumble, often do so with extreme volatility. If we've been sizing positions and placing stops based on the contracted volatility, these turns can be one place a trader can lose much more than he had intended.

There's also a psychological danger here; this trending pattern encourages mistakes. A trader might look at a market trending like this, and see that it's gone on for much longer than he expected. An undisciplined trader might now begin to feel some emotions--perhaps he is angry or anxious over "missing the move". Now what to do? He's becoming more frustrated waiting for a pullback or correction, because these types of trends have very few corrections--it's really hard to find a place to jump on board. If he just decides to get on anywhere, now he's vulnerable to nasty shakeouts that come in these trends. (And, perhaps it's Murphy's Law or, more likely, a reflection of how prices reflect crown behavior, but his entry is likely to come just before one of those nasty shakeouts. I, personally, have been there, done that, have the t-shirt, and booked the losses... more than once!)

On the other hand, he might be inclined to fade the move because it has "obviously" gone too far. Well, the problem here is that these trends tend to be very powerful, even though they may be quiet. They reflect market forces that have the potential to drive the market much further than anyone would think possible. Fading a trend like this is a really good way to lose money while compromising your emotional and psychological state as a trader.

Why is this discussion relevant? Look at the Nasdaq daily index. This is how this type of trend begins. Perhaps this is not the beginning of one of those "slide along the band" rallies in stocks, but, if it is, there could be many, many months of steady uptrending action in the future. (It goes without saying that a trend here should generalize to other major indexes in most geographies.)

One of the tasks of trading is to watch patterns as they unfold, and to create roadmaps that show both what should and should not happen if certain scenarios are valid. This market provides a good exercise in this concept, and a good opportunity to learn. Watch this pattern as it develops, and guard against the kind of mistakes these trends encourage.