Selective Intraday Trades: A Deep Dive Into the Snap Pullback

Today, I want to share a trade in the S&P futures market. Here’s what I hope you’ll get from this short blog post:

- A deeper understanding of the snap pullback

- A real-world example of that trade, with thoughts on setup, entry, and trade management

- Some thoughts about trade selection

Snap pullback

I’ve written extensively about this trade, which is my re-naming of the Anti trade. (See

The Art and Science of Technical Analysisfor solid background information on the trade.) Here is a good discussion of the specifics of the trade, with some thoughts on why I chose to rename it, drawn from my most recent Hudson Session talk.

This trade is a variation of the pullback. Its strength lies in its timing—it comes just after one side of the market (bulls or bears) has lost control and the other side is beginning to take over. This leads to a trade that has good potential to see quick, sharp followthrough in the direction of the new trend.

The Trade

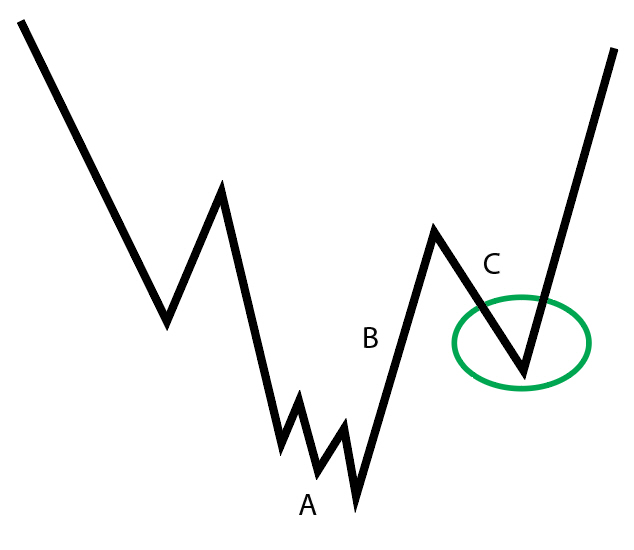

This trade follows a predictable pattern, but it requires some understanding of market dynamics. In other words, there’s no simple pattern you could write down on a napkin and then find with reliability. But if you understand just a bit about how to read the market, then it all falls together. See the schematic diagram:

The market begins in a strong downtrend. This downtrend gives some reason for potentially ending, at the point marked A. You must understand the usual patterns of trend termination: big-picture ideas like overextension, climax, and loss of momentum, and also smaller bottoming formations like three pushes, variations of reversal complexes, etc. This is critical—you’re not just looking to fade any downtrend; you’re looking to go long after a downtrend shows signs of ending.

The next step is a strong snap up, against the old trend, marked B on the chart above. Keep in mind, you are not involved in this trade at this point! This is great training for traders who fight FOMO—realizing that you will miss the first move, and it is okay to miss the first move, is great psychological training. But the important thing is, now, the bears have almost certainly lost control of the market.

When the market naturally rolls over, the bears have a chance again. Can they take control and slam the market to new lows? Can they generate real downside momentum and significant selling pressure? We don’t bet on any of that—we stand aside and wait. If the best they can do is to create a mild selloff (a “reluctant pullback”, as I often characterize it), then, and only then, do we have the potential for a trade.

Once we’ve seen this sequence--sharp countertrend momentum following a trend that shows some clear signs of termination, and then a reluctant pullback--we have a reason to look for a trade entry somewhere in the green circled zone.

A real world example

Now, look at this chart, drawn from the morning of 10/6/23. The market sold off aggressively following a better-than-expected report on the labor market. This selloff appeared to have been overdone, showing a potential double bottom with failure to follow through just before 9 AM.

From that point, the market rallied aggressively, easily recovering 50% of the news-driven decline. When the market opened, the selling pressure was muted and we had a reluctant pullback.

I entered a long trade when the market broke above recent resistance, and set a profit target just inside of the measured move objective for the structure.

This is a solid example of a basic pattern that you can apply over and over, in whatever timeframe you trade, in whatever market you trade. It does require some understanding of how the market moves, and there’s an element of subjectivity involved. (I don’t think you could reliably program all variations of this trade in an algorithmic system.) If there’s a negative, it’s that this reliable pattern doesn’t set up all that often—maybe not often enough to be your bread and butter trade.

If you aren’t already using the snap pullback, spend some time this weekend looking at the pattern, and see what a change it can make in your trading.

Being selective

Aside from the empirical strength of this trade, I think there are two powerful lessons for traders.

The first, as I mentioned above, is the importance of facing and accepting fear of missing out. I often tell our MarketLife members that we will miss the first move, and that it is okay to miss the first move.

I don’t have data to support this, but I would bet that more dollars have been lost, and more trading careers ruined, by FOMO than by any other factor. FOMO gets us out of good trades, causes us to skip the easy trades, and forces us to always fight the market. FOMO kills. The Snap Pullback is, specifically, an anti-FOMO trade because you must miss the first move to trade it!

Second, you really have to be selective as a trader. It seems like the market is an unending stream of opportunities, a notion often magnified by deceptive marketing from trading educators and brokers who all want you to place trades! In reality, you really have to pick your spots. Trading success hinges on discernment. You have to pick the best spots, and only make trades in those spots.

If you can do that, you dramatically increase your chances of making it in this brutal business. I made two trades this morning—the trade I wrote about here, and a follow up trade on a bull flag that is a “must enter” for my trading approach. I’m content to be a spectator for the rest of the day, unless another great opportunity presents itself. Learn to wait. Learn to be patient. These are critical skills for successful trading.