Probability and Strings of Losses

I received a question from a reader, David:

Hey help me out please. I was reading a good blog by a smart math guy and he said that your next trade is always 50% chance of win. No matter what your overall win ratio is the next trade is always 50% chance. Like if your system is 75% wins, the next trade is only 50% win loss. Is that right? It's confusing if it is.

Good question. Probability can be very confusing, and the short answer to your question is no, whoever wrote that is not right. (But even though it's wrong, it might be useful.)

The best way I've found to think about problems like this is to turn them into something simple and physical. In this case, let's think of colored marbles in a bag, and let's simply it so your system has an 80% win rate. The way to model this would be with a bag with 10 marbles in it. There are 8 blue marbles (winning trades) and 2 red marbles (losing trades) in the bag. We can easily see that 8/10 (80%) of the marbles in the bag are blue winners.

Now, reach into the bag and grab a marble. Without looking at it, do you think it's more likely to be blue or red? Obviously, it's more likely to be blue. This, in fact, is the definition of win ratio in a trading system: any one trade, drawn at random, from the trade results has an 80% chance (in this example) of being a winner.

Now look at the marble. We don't know before you look if it's red or blue (and I suspect this is really the author's point). Now put it back in the bag. I shake them up, and you reach in and take out another marble. (We are sampling with replacement here. If we do it without replacement (not putting the marble back), things get a little weird for this example.)

I think you can easily imagine two things with this little experiment:

- The marble you draw always has an 80% chance of being blue. The author's statement (assuming you didn't misunderstand him, which is possible) is clearly false. The next trade has whatever your average win rate of the system is chance of being a winner. It is not 50%.

- But... we never know what the next marble you draw will be until you open your hand and look at it.

That is probably the author's point, and it's a good one. The Gambler's Fallacy is a well-know cognitive defect (we usually use the kinder word "bias", but in this case it just makes humans stupid... let's call it a defect so we can work around it!) that makes us think something is "due". Go to a fair coin example for a moment. If I flip 4 heads in a row, are you somehow a little more likely to think the next flip should be tails? What if I flip 10 heads in a row?

In these examples, assuming the coin truly is fair, the next flip is always 50/50, no matter how many strings of heads or tails have come before. The coin has no memory of past flips and there is never any case in which something is "due" or more likely based on the past.

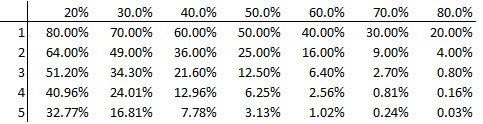

In the marble example, the next marble is 80% likely to be blue. Let's say you get unlucky and pull out 3 red ones in a row. (That will happen if you do this long enough, by the way. There's a little less than a 1% chance of pulling 3 reds in a row.) Is the next marble somehow more likely to be blue, or is it still exactly 80%?

I suspect this author knew the math but just tells himself the next trade is 50/50 so he doesn't, for instance, bet more on a winner after a string of losses. Maybe so he doesn't get frustrated and make other mistakes after a string of losses. Maybe to remind himself that strings of losses arise just out of random chance, and might not reflect something he's doing wrong.

(This is a problem with the naive and classic "trade review" system. Why would you sit down and review your marble drawing technique after you draw three reds in a row? You just got unlucky with this run, and that's fully to be expected given the probabilities of the bag of marbles. Many trading problems people try to "fix" are the same.)

By the way, it's the same with winners--long strings of winners should not make you feel invincible and take on more risk. They also shouldn't make you scared and think things like "my luck can't last. I'm due for a loss..." Randomness can be very counter-intuitive at times, and one of the thorniest subjects is strings within random data.

Now, we should think about how this impacts behavior and trading psychology, but that's a subject for another day!