One, two, three steps to shorting stocks

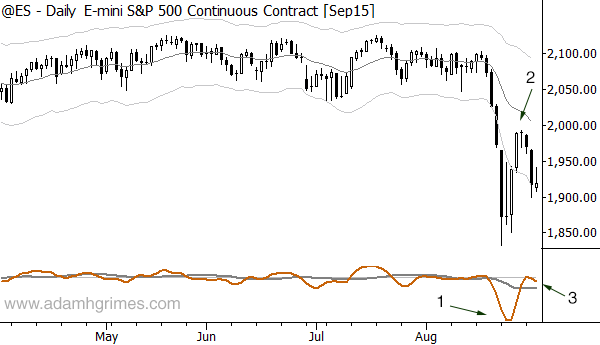

I want to share a quick short setup in the S&P 500 index today. This is a repeatable pattern, and draws on many elements I have discussed here on my blog, and also in my book, The Art and Science of Technical Analysis. Take a look at the daily chart of the S&P 500 futures:

Here are three quick points that set up an excellent short entry:

- A new momentum low, relative to recent price history. In this case, a new low on the MACD provides a quick, visual marker for this new downside momentum. Strong momentum usually leads to a retest.

- The market pulls back. There's no moving average magic or anything here, but the market pulls back from the extension is a fairly orderly fashion. (These posts on pullbacks (here and here) will give some insight into the pattern.) Don't worry about what you label the pattern or if it conforms to some classical chart pattern--leave these arguments in the chat rooms and focus on what the pattern is doing, which is correcting the short-term downward extension.

- The market rolls over, which could be the beginning of another leg down. Where and how you enter is subject to a lot of personal taste, but the MACD fast line hook provides another quick confirmation.

I think there's an important point here, that has the power to change your trading mindset. Why am I short stocks? Not because of anything the Fed might or might not do (that's one of the biggest places people are wasting time and mental energy right now), not because of any political opinion, and not even because of any arcane technical indicator. (I'm sure we could find some Fibonacci stuff here that would please the True Believers, but you don't need it to trade.) I'm short because of a simple pattern.

Furthermore, I know what has happened, over tens of thousands of similar patterns in all markets and all timeframes. I know the coin is slightly loaded--the odds are slightly tipped--in favor of my short. Will stocks collapse 45% next week? Maybe. Will the market spike higher tomorrow, ripe the face off all the shorts, and not look back? Maybe. I don't know, but I do know if I do this trade over and over, with correct stops and correct trade management, I'll very likely make more money than I lose, and that, friends, is the best we can hope for with any trading strategy.

(If you're interested in more of this analysis, please allow me a shameless plug for the research I write for Waverly Advisors. Our clients cover the full range from individual to institutional, from deeply experienced to developing traders, and I'm very proud of the work we do and the value we offer our clients. If you'd like to see our work, we offer a free, no-obligation trial.)