On Shorting Stocks

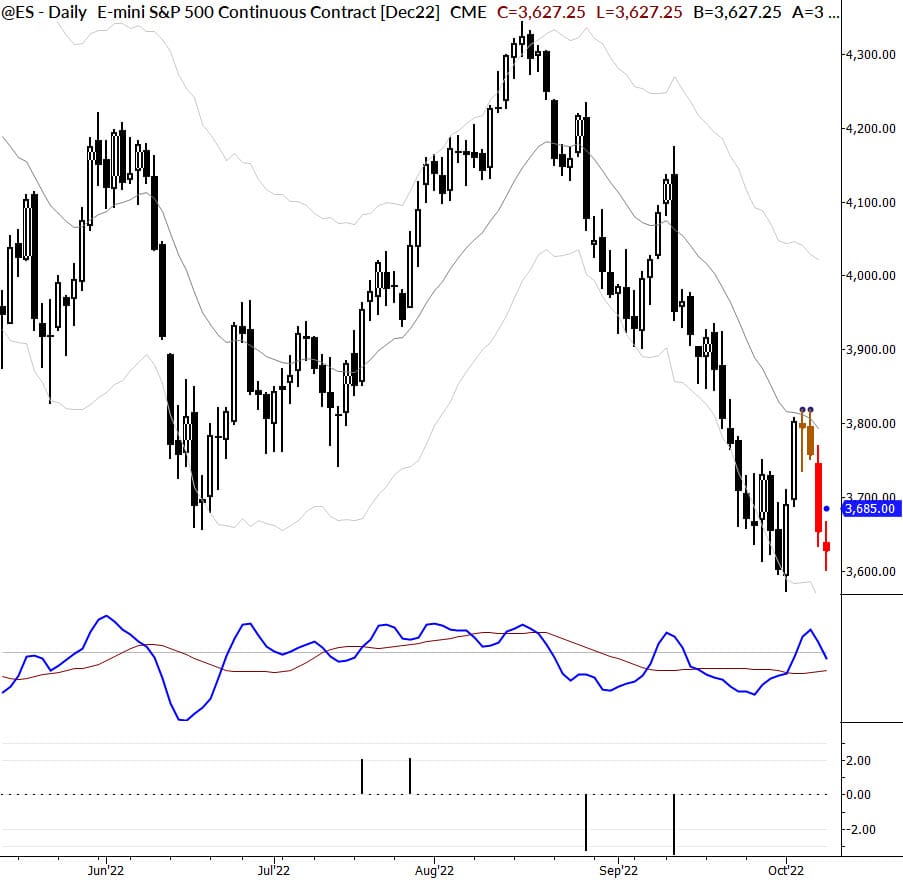

A few thoughts on shorting stock markets, which may prove to be especially relevant here, as we head into the end of 2022.

Long-term stock bias

One of the most important things any stock trader must keep in mind is that stock markets have a strong upward bias over any longer timeframe. In fact, this is one of the most certain relationships in financial markets, and an entire industry has built up around “indexing”, which simply means allocating your money to a broad index of stocks. Burton Malkiel, of course of course, is the high priest (and certain chief marketing officer) of this approach, and most of your friends who work in “finance” probably spend most of their time putting people’s money into index products.

The upward drift of stocks is about as close to a sure thing as we can find in markets, and the people who tell you that your investment in a stock index is extremely likely to be higher in 10 years are absolutely right. Simply putting some money into stocks and not touching it is a time-tested path to building wealth.

It’s not hard to see the truth of this upward bias, but it’s easy to forget it in the heat of battle. Spray paint this on the walls of your trading office: stocks usually go up.

Shorter timeframes

Does this influence trickle down into shorter timeframes? Absolutely, yes.

It can be no other way: let’s say we had a trading system that simply bought any random close in the market and then sold a few days later. If we are executing this in an index and do many trades, we are very likely to make money with such an approach. (And here we see how so many well-intentioned but math-challenged trading gurus and authors get backtests wrong. There’s an old saying, “never confuse genius with a bull market”, but it applies even to tests of moving average crossover. Never confuse the results of your tests with the baseline drift. Never do statistical tests against a zero baseline for stocks!)

This is also why even many short-term stock trading systems are long-only, and why statistically effective short signals may still lose money. I’m stressing this point because you must respect the upward drift of stocks, especially if you choose to play the short side. There’s probably no one more ignorant or dangerous in the industry than the so-called permabears. Trading on their advice will cost you all your money.

Going against the stream

So, if we are shorting stocks, we are going against one of the strongest, clearest, and most persistent biases in financial markets. Why would we do such a thing?

One reasonable answer is we should not. You can make a strong case for never shorting stocks. It was Larry Williams who opened my eyes to the fact that you can trade even collapsing bear markets from the long side only. Fortunately, my eyes had been opened in time for the 2008-2009 bear market, and we retained the flexibility to trade both sides of that market. However, if we’d only concentrated on the long side, there was still plenty of money to be made.

Also, be aware that shorting individual stocks will not work like it does in your backtests. Stocks are frequently unavailable to short, and shorts may even be bought in by your broker without notice. (I’ve had short legs of spreads bought in (i.e., removed) by brokers in bear markets and not been notified until the following day. At some points in 2008, even SPY and QQQ were unavailable to short!) You also will pay a pretty penny in borrowing costs for good shorts (sometimes well in excess of 100% a year). Options provide a way to short otherwise unavailable stocks sometimes, but there’s no free lunch—these costs are baked into the cost of the options as well.

Given those costs, I think a strong argument can be made for focusing shorts on index products, and here are some reasons you might want to think about shorts:

- Short patterns often resolve (i.e., hit your profit targets) faster and cleaner

- Short patterns may be easier to read. Perhaps this is a highly personal element, but I’ve found it to be the case in my own trading—solid short setups jump out from the chart and are generally high probability plays. I think this says something about the emotions encoded into chart patterns, but you will find many clear examples of shorts in the right environment.

- There’s a lot of money to be made from good shorts, but also, of course, considerable risk. Managing that risk is job number one.

How and when

I began this post with arguments for not shorting at all. Let me now suggest a way to see and use that information constructively: treat all shorts, at all times (even in roaring bear markets), as countertrend trades. Assume that the bull market is about to reassert itself while viciously kicking you in the face (or in softer parts of your anatomy). Treat every short as a hand grenade on which you just pulled the pin—how long are you going to hold that thing in your hand?

So, that’s the key to managing shorts: use clearly-defined profit targets, and run for the exits at the first sign of anything going wrong. It goes without saying that liquidity reigns supreme—try to avoid shorts in markets where you might have an issue getting out. Be careful of your size. Pigs get slaughtered.

As for entering shorts, a few guidelines will help:

- Only look for shorts when the environment favors them. Macro context and/or bigger-picture technical factors (market structure) will show you the way here.

- There are, broadly speaking, two ideal points for short entries: either at overextended (overbought) points to the upside, or in consolidations following strong selloffs. In my experience, the latter provide cleaner and easier trades.

- In stocks, volatility will expand in a good shorting environment. Be sensitive to the cycle of volatility on shorter timeframes, and look to enter ideally after volatility compression.

- (That might be confusing, but imagine this: imagine we are in an environment where the VIX is generally holding above 25 or 30, and has some big spikes into 70+. The news media will be constantly spewing doom and gloom and stocks will be very unpopular. This is the overall context, but try to avoid making your short entries after big bars on the daily charts. Wait for smaller bars and specific technical triggers that show volatility compression. These are practical tips that will keep you from chasing trades.)

- Only trade clean patterns. If you’re focusing on trades with momentum, you’ll know it when you see it.

- Nested flags are good entries.

- If something doesn’t look right, get out.

- Gap openings and other adverse events are a constant risk. Be careful of heavy shorts.

Conclusion

In my opinion, we’ve been in an environment where it does make sense to lean on shorts. I’ve been holding some puts with good vega in major indexes (and rolling them out in time to keep the volatility exposure crisp) for several quarters, and we’ve also had a number of solid short setups in indexes. Though these puts haven’t made money (yet?), judicious and fortuitous entries, combined with the tailwinds of price movement and slightly elevated volatility, have offset the cost of time decay. This doesn’t work in all environments, but it’s been right for now (and we were able to give this call to our MarketLife members very early on.)

You must have a clear plan as to how you will manage and deal with any further stock market weakness. (As I said, trading from the long side, but with shorter holding periods, is absolutely a possibility.) Many mistakes are made in stock markets under stress, and I hope this article can help you avoid some of those mistakes—and maybe even unearth some hidden treasure!