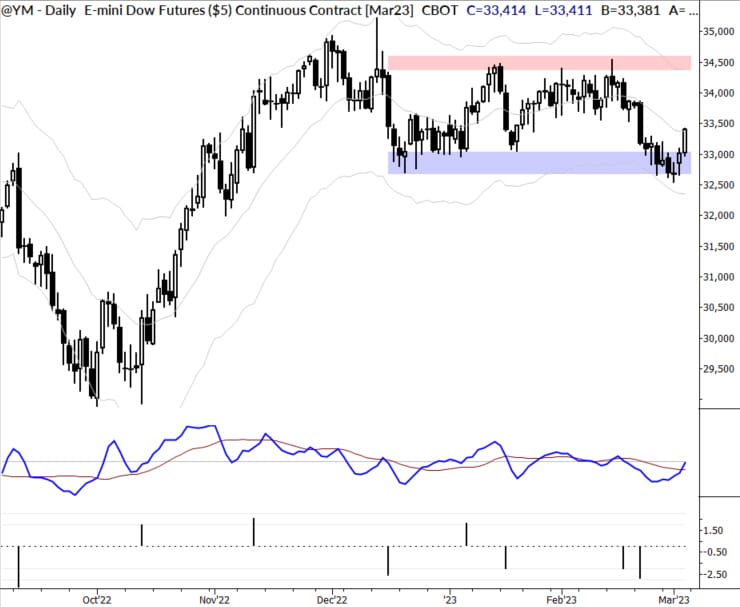

Markets unlocked 3/6/23: Strength from the bottom

The last few weeks have seen stocks under moderate pressure. Though bullish patterns have degraded on daily charts, our read of market conditions has been that this has not been the type of weakness that leads to further, significant selling. So, for intermediate-term swing traders, we've argued the correct position has been to stand aside.

Though it's too early to tell, there's a very good chance that we have just seen a major turning point in the market. The explosion from the bottom of the range (see pic) is exactly the type of action we would expect to see if support is holding, and could lead to a breakout to new highs. We will be watching carefully this week to see if further development of this pattern leads to good long setups for swing traders.

Join us at marketlifetrading.com to see how we translate fundamental principles of trading and current market structure into actionable trades.

The week ahead (potentially market-moving datapoints)

- Monday: Factory Orders

- Tuesday: Powell testifies to Senate

- Wednesday: ADP Employment, JOLTS, Powell testifies to House

- Thursday; Jobless numbers

- Friday: Unemployment