A few lessons on risk in short volatility strategies

There are so many “teachable moments” in recent market action, it’s hard to decide where to start. I think one of the clearest lessons comes from the recent implosion of short volatility products such as XIV and SVXY—good lessons here on volatility and on risk in general.

What happened?First of all, a little history: Over the past decade, we’ve seen more and more Exchange Traded Products (ETPs) that allow anyone with a stock account to trade many different things just by punching up a stock ticker. Some of these are great for diversification and international access; we can buy positions in many different stocks, both at home and abroad, with a single ticker.

Others are more problematic because they allow stock traders to trade things like commodities. If we understand the risks and different characteristics of, for instance, gold, crude oil, or the British Pound currency, we have an easy way to trade them. If we expect them to behave like a stock and think about “investing” in these things, we’re probably in trouble.

Other products are so dangerous that we could argue it’s irresponsible to make them available to the public. Some levered products fall into this category, and one of the things I’ve watched with great concern was the growing number of volatility-related products.

Many of these products appeared to have very predictable characteristics—they declined with apparently astonishing predictability. This led to a group of traders who advocated shorting these products, and to a large group of uneducated, inexperienced, and unskilled traders setting themselves up as social media gurus around this concept.

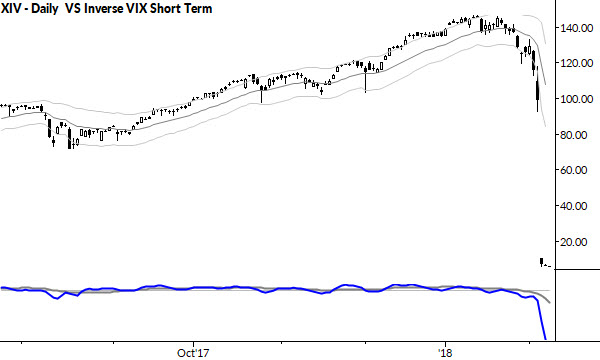

For several years, these strategies appeared to offer consistent returns. In early February (2018), the bill came due: volatility came back into the market with a vengeance as realized volatility spiked. After the close on 2/5/18, VIX futures exploded, and some of the corresponding ETFs crashed. XIV (an inverse product that “goes down when volatility goes up” (more on that in a moment)) closed that day at 97.01. A few hours later, it was trading below $5.

Similar moves occurred in other products, and many traders experienced devastating losses. As I write this, a few days later, social media is filled with talk of class action lawsuits, and “traders” talking their book, buying more, and talking about how it “has to go back up to at least the XXX day moving average.”

The lessons

Let’s focus on some good things we can learn from this: 1) never trade a product you do not understand. 2) never trade a strategy you don’t understand.

Never trade a product you don’t understand. Many people had the facile and simplistic understanding that “this thing goes up when volatility goes down” or “this thing always decays so it always makes sense to short it.” Of course, it’s more complicated than that. What, exactly, did the product track? In most cases, VIX futures, but where on the curve? What are the VIX futures? What’s the VIX? How are these things tied to volatility in the market?

These are important questions. Years ago, when these products started appearing, I advised many people to exercise extreme caution trading them because you might be trading a derivative of a derivative of a derivative of a derivative, and there are many surprising ways you can lose in such a chain. Consider a simple strategy of buying a put or a call for a directional move on a stock—there are plenty of ways you can be right on your stock call and still lose money. Imagine how much worse this can be!

Sadly, there was a small army of social media idiots who set themselves up as experts in groups with witty names like “the Short Selling Academy.” With a simple message like “these products always go down so all you have to do is to short them”, they gained a following and no one stopped to think that the gurus might be trading (or not) a $2,000 account while they dispensed expert advice. Truly a case of the blind leading the blind.

For a new trader, it’s hard to know what you don’t know and hard to know who to listen to. Social media credibility can easily be built in “fake” ways, and so-called experts may, in fact, have no idea what they are talking about. What can you do?

Well, first of all, you can get a solid education in some trading and market basics. One of the core understandings—perhaps the most important—is that there’s no free lunch. If you think you’ve found a risk free opportunity or something that provides steady income with essentially no risk, you’re missing something. If there’s opportunity, there is always risk; the two are inextricably wound together. If you don’t see the risk, or if the risk seems very small, you’re missing something. Work to understand the risk.

Next, you do need to understand the mechanics of the thing you are trading. How much and in how much detail? Well, it’s your money, so you can decide. At the very least, reading the prospectus would be a good place to start. In the case of the XIV and related ETNs, the prospectus includes 16 pages on Risk. Our natural inclination might be to assume that’s a lot of CYA legalese. Some of it might be, but some of it points to real risks. An hour or so spent reading this before you risk your account might be a good idea.

As for understanding the strategy, this is perhaps even more difficult, but here’s a golden rule, which is tied to the “no free lunch” rule: if a strategy loses very rarely, those losses can be huge. In some kinds of trading (e.g., directional swing trading), we might win about as often as we lose, and wins and losses are about the same size. Consider a trend following who might lose much more frequently than he wins. In this case, his losses should be much smaller than his wins.

But strategies that rarely lose come with big problems. In the case of shorting option premium, you might almost always win. You might, in fact, win so often you think you can start calling it “income” because you just make a trade and get income. What you are missing is that your losses, when they do occur, can be many times your average win. If you haven’t structured the trade properly, a loss could be enough to wipe out your trading account or, in some cases, your entire net worth.

These are kinds of risks that short volatility strategies carry. It doesn’t matter whether you are trading them through options, futures, or an ETN on futures, except that more links in the chain lead to more complexity and more ways to lose. If you don’t understand the basic risks of being short volatility, you’re taking unacceptable risks to your trading account.

For some traders, this lesson comes too late and they are already out of the game. If you got lucky and weren’t hurt in this event, double down your efforts to understand the risks (and associated probabilities of incurring the losses from those risks) of anything and everything you trade. If you were hurt, then use this as a lesson to understand why and think about how you can guard against this type of event in the future.

Risk isn’t bad. In fact, our job as traders is to take on the right kinds of risk. A kind of silly way to think about it is that risk is the fuel we put in the “trading engine” to make profits, but that silly analogy isn’t far off. We need to understand the risk and make sure we are taking the right kind of risk at the right time and in the right amounts. Mis-understood risk is the killer, so work to understand your risk.