Do you really want to know what's happening with the Economy?

I want to share something pretty cool with you: the quarterly macro piece I publish for my institutional advisory clients at Talon Advisors.

This report grew out of work I had been doing for years, but hadn't really shared with anyone. I do focus very heavily on technical information, and that's not an accident.

The reason for focusing on technicals is that markets lead economic data with a high degree of reliability. In other words, if you wait for the turn in the macro data, the market has already moved without you. (This is one of the great "secrets" of investing that the industry doesn't really talk about--most of the people looking at economic data get timing dramatically wrong. When timing is wrong, everything is wrong.)

However, fundamental data does matter. Fundamental data provides context and structure. It can tell us when a turn is more likely to extend, or when it's more likely a trend will continue. There's nuance to all of this, but understanding fundamentals correctly puts you in control.

One of the other reasons I starting publishing this work was to help my clients become more intelligent consumers of financial media. The news tells you some crisis or disaster happens nearly every week (to generate clicks or views), but the reality is that most datapoints don't matter. Most data series have some much noise in theme that the month to month fluctuations just aren't important.

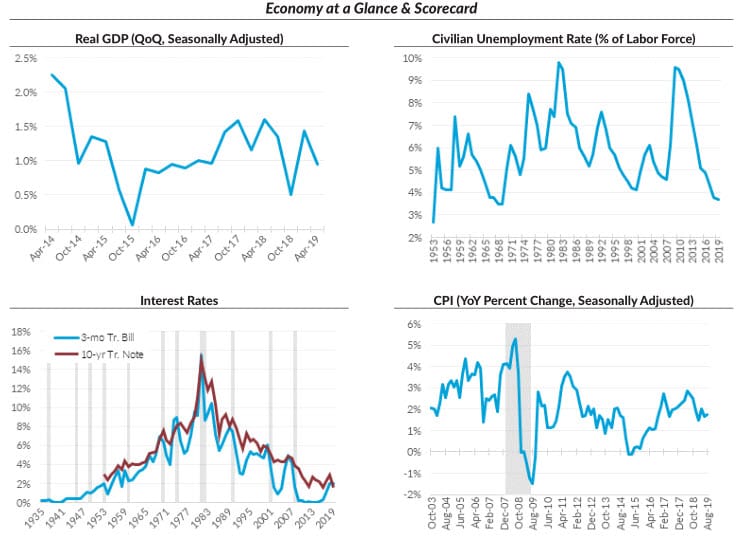

One of the best ways to see this is to look at recent data in context of long history. In this report, you'll find some data series going all the way back to the 1930's. That's long history indeed!

You'll find a lot in this report:

- Data series on all the important economic indicators, and some commentary on what they mean.

- GDP broken down by contributing elements.

- Global GDP's, growth rates, interest rates, and unemployment.

- "Flashpoint" economies that are especially subject to stress in coming quarters.

- Relative performance of major asset classes.

- Volatility analysis and what it means for markets.

- Seasonal factors for major markets, commodities, and currencies.

- And much more...

Download the report here.

If you want to see more of this work, your might want to take a no-risk, no obligation trial, and check out my work at Talon Advisors.