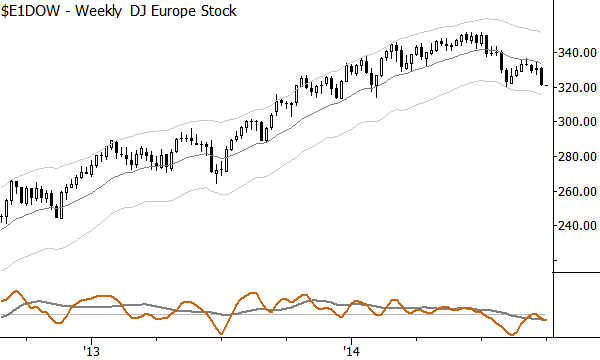

Europe is vulnerable

We are seeing a potential divergence in the performance of US and European stocks. European stocks are showing overtly bearish patterns, lead by clean breakdowns out of weekly bear flags in France and Germany. US stocks have certainly suffered, but the best shorts are likely to be in Europe. There are a number of ways to manage shorts here, but they are supported by weekly market structure as well as short-term momentum. A very sharp rally would contradict this trade, so reasonably wide stops (perhaps in the neighborhood of last week's high) are needed.