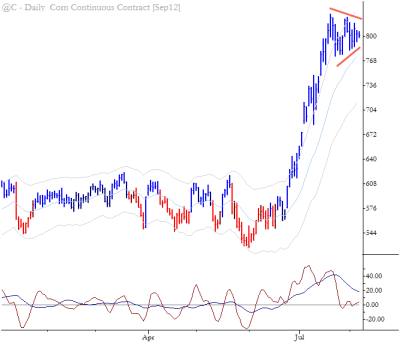

Chart of the Day: Volatility Contraction in Corn Futures

Markets alternate between periods of range expansion (usually during trends) and volatility contraction. Breakouts from periods of volatility contraction tend to be strong, and highly directional. This chart pattern in Corn futures highlights volatility contraction near the highs of a recent, large run-up; this is usually constructive and traders can look to position long on a breakout of this pattern. Also, consider that there will be trapped longs should this pattern fail, and have a clear plan for risk management to the downside. (Note that there is also the possibility of multiple locked-limit moves in the Grains.)