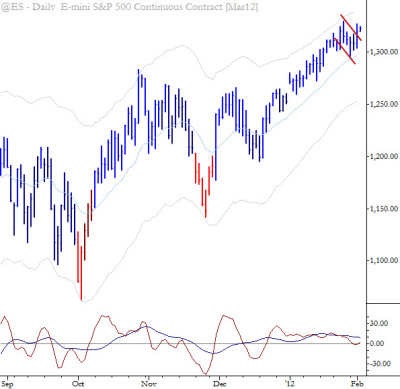

Chart of the Day: 2/2/12

[dc]W[/dc]hen faced with a strong uptrend with no pullbacks, as we've recently had in major domestic stock indexes (S&P 500 futures pictured in this chart), traders have a difficult decision: One, this contracting volatility makes the market vulnerable to a sharp selloff as there are likely many complacent longs. Any weakness will hit stops, which will trigger more selling, and a feedback loop can develop. On the other hand, it is hard to position in a trend like this because sometimes there simply will be no pullback. The question of the day is, "was this the pullback?" It's worth pursuing longs aggressively here, but be alert to the classic signs of pullback failure as there may be higher-than-usual danger on any decline.