Ancient Wisdom / Modern Markets

Wisdom from ancient Eastern texts offer guidance for modern traders in all markets.

[dc]O[/dc]ne of the interesting things about writing a large book is the amount of stuff that ends up not going in said book. The Art and Science of Technical Analysis is primarily about trading, the process of trading, and reading the patterns left by buying and selling pressure in the market. One of the issues I struggled with was how, and how much, to address the psychological aspects of trading. On one hand, I wanted to focus on more or less pure market analysis; on the other hand, no trader stands any chance of applying that knowledge profitably without iron discipline and a firm mastery of the psychological elements of trading.

In the end, much of the early material I wrote on psychology and the process of trader development did not make the final cut. The good news is that I will explore much of this territory in this blog--I have insights from my experience as a professional musician, a teacher of musicians, and also my experiences mentoring and teaching traders that are very relevant. I also have a perspective that is radically different from most other educators'. Though it is certainly a reflection of my personality and my philosophy, I do not find an emphasis on competition or aggressiveness to be productive. For me, it far more valuable to understand how to read the flow of the market and then to orient myself with that flow. Furthermore, I wonder if some of the current thinking on trader development (i.e. emphasis on elite performance principles) is somewhat misguided. I have come to believe that the process of becoming a trader has parallels in Joseph Campbell's Hero's Story

and even in Carl Jung's application of alchemical symbolism to psychology. I will explore these concepts in the future, but the unifying concept is transformation. Becoming a trader is about the transformation of many of our abilities and traits into the skill set of a successful trader. I have come to believe that many traders who fail do so because they do not understand the nature, the scope, or the challenges of transformative journey. It is not about learning to be a trader--we grow to be traders

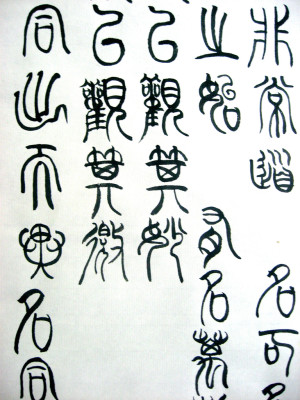

I have also been influenced by my background in martial arts when I was growing up, and by my formal study of Eastern religious texts later in my college years. In the process of planning and outlining the book, I collected a set of quotes from some of these ancient texts that I intended to use as departure points for sections of the book. In the end, I decided to not do this for a number of reasons. For one, it wasn't completely coherent with the tone of the rest of the work, but, on another level, I feel the constant use of these texts in business books and seminars trivializes them in some sense. Today, let me share three of the quotes I decided not to use. I won't elaborate on these, but I encourage you to spend some time thinking about them and how they might apply to your trading.

If you open yourself to insight, you are at one with insight and you can use it completely. If you open yourself to loss, you are at one with loss and you can accept it completely. Daodejing-23Do you have the patience to wait till your mud settles and the water is clear? Can you remain unmoving till the right action arises by itself? Daodejing -15The quality of decision is like the well-timed swoop of a falcon. The Art of War