10000 hours, trading, and what really matters

This is the third, and last, post in a series of three posts that started by looking at the 10,000 hour fallacy and the importance of deliberate practice. Those posts were broad in scope, and some of you asked how to related them specifically to trading and financial markets. That's the point of today's post: why deliberate practice fails most developing traders, and how to approach the problem of trading smarter.

More answers, better answers?

Research can be confusing because answers are often unclear. We would like to think that science is black/white, true/false, but this is not at all the case: answers only come within the bounds of statistical uncertainty, researchers have motivations and perspectives that shape those answers, and many answers that appear to be solid defy replication. Errors in thinking can persist for decades. (We're seeing a good example of this now with the revision of thinking on low-fat "heart healthy" dietary guidelines that were supported mostly by research funded by sugar producers.)

Some of the best answers tend to come from meta-studies, which are large studies of other studies. A researcher doing this work has an eagle-eye perspective on a lot of data and different methodologies and can often create analytical techniques that compensate for the weaknesses and biases in some studies. No, there's still no certainty, but a good meta-study will often get us closer.

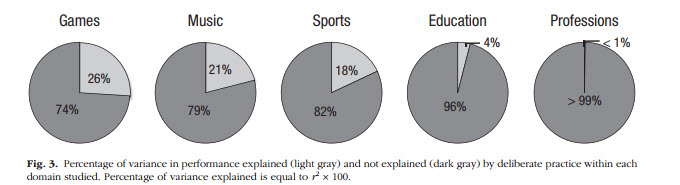

Brooke Macnamara, Hambrick, and Oswald published a substantial metastudy of the deliberate practice literature in 2014 (alas, to nowhere near the fanfare created by pop science bobbleheads over the "10,000 rule"): Deliberate Practice and Performance in Music, Games, Sports, Education, and Professions: A Meta-Analysis. That paper is worth your time to read, but here is the authors' conclusion, followed by one of the charts from the paper (emphasis mine):

Ericsson and his colleagues’ (1993) deliberate-practice view has generated a great deal of interest in expert performance, but their claim that individual differences in performance are largely accounted for by individual differences in amount of deliberate practice is not supported by the available empirical evidence. An important goal for future research on expert performance is to draw on existing theories of individual differences to identify basic abilities and other individual difference factors that explain variance in performance and to estimate their importance as predictor variables relative to deliberate practice. Another important goal is to continue to investigate how and when task and situational factors such as task predictability moderate the impact of deliberate practice and other individual difference factors on performance. Research aimed at addressing these goals will shed new light on the underpinnings of expert performance.

Things that matter

The conclusion of this paper was that 12% (that's the take-home number) of variation in performance was explained by deliberate practice, across a wide range of situations and fields--twelve percent. That is not most, nearly all, or even a lot. It's some. It probably separates the very, very good from the absolutely top in some of these fields (but maybe not--that's an assumption not supported by the research). For everyone else, it's probably important, maybe very important, but it's also clearly not, based on this study, the most important place on which to focus.

I think one of the other key points is that deliberate practice seems to work best in highly predictable fields. You tell me, is learning to trade more like learning to play a Beethoven sonata on the piano--a task in which nearly every aspect is known and defined beforehand--or is it more like fighting forest fires? We can see clearly from the chart above that deliberate practice appears to fail in explaining peoples' success in professions (and, perhaps, in education), so perhaps this is not where traders should be focusing.

I think one of the problems with learning to trade is that there are no, true, "fundamentals" of trading. Before you object, let's consider fundamentals in other fields. In music, we have basic aspects of technique and theory. In knifemaking, we have fundamental techniques of moving hot metal, managing stresses in the piece, and controlling hardness. Every sport has a set of techniques that can, and must, be assimilated into muscle memory. In chess, we have the endgame, fundamental pieces of tactics and combinations, and patterns that occur, with variations, over and over.

Is trading the same? Though people have substituted things like booking screen time and doing silly keyboard drills, I would argue that the "fundamentals" of trading have been misunderstood. These are primarily psychological skills relating to performance under risk and pressure. There are ways to move toward mastery of this psychology--both from an emotion and intellectual perspective--but one of the critical factors is time. A beginning trader is a nervous, twitching mess every time he even thinks about putting on a trade. He swings between extremes of elation and depression with every tick. He can't see or think clearly (literally cannot because his brain is chemically compromised by the emotions of trading) while the market is moving.

If that trader does not blow himself up, after a few years he stops caring so much; he becomes desensitized to the movements of the market. The emotions naturally abate as he moves toward mastery. (An important linguistic note: English encourages the use of the gendered pronoun, so I realize I've written "he" throughout this explanation, but women, who account for a tiny percentage of traders, generally do this better and faster than men. More women should probably be traders because they seem to adapt to this world much quicker, in my experience, than do men!)

We need exposure to market patterns. We need education. We need to understand statistics, probability, cognitive bias, market microstructure and efficiency--all the things that explain why trading is hard, but we also need a lot exposure to the market and a lot of times at bat.

Discipline fails

I gave a presentation last week to a group of options traders who work with a good friend of mine. In that presentation, I argued that we think about discipline the wrong way. We tell traders they must be disciplined, and they fail to be disciplined. Why? It's not because these traders are stupid failures or that we are incompetent teachers--it's because we are asking the impossible. Discipline is an outcome as much as it is a goal. Discipline shows that a lot of things are working correctly in a trader's world, and that the trader has achieved some degree of mastery. To tell a developing trader to be disciplined is akin to handing someone a basketball, putting them on the free throw line, and telling them to sink 50 in a row.

Discipline is the outcome of the right mental framework, emotional skills (largely including the systematic desensitization to the stimuli of trading achieved over many years of exposure), and process. These things matter, and perhaps we don't focus on them enough.

What might matter most

One of the things that always bothered me about the 10,000 hours was that it did not line up well with my experience. When I started music, frankly, I was almost immediately "good". Though I started late in life (for a classical musician) I easily leapfrogged people who had been studying for years, and, perhaps even more important, I loved it--there was a virtuous circle in which I saw that I had skill, which reinforced my excitement and love for the field (passion), which led me to develop more skills. I can see a clear difference between the things that I have tried to do with moderate success and the fields in which I have achieved some significant degree of mastery. In the latter, I always had that "aha" moment at the beginning--some early successes, and an immediate attraction for the field.

When I had the experience of teaching a reasonably large body of music students, I saw some did much better than others, regardless of my effort as a teacher. In fact, because I was so aware of my potential failings, I think I worked harder with and for many mediocre students. Sometimes they sucked because they didn't care (not to mince words!), but that was not always the case. I saw several cases in which the students put in time, but just simply did not get the same improvement that someone else might have. I could also make the observation that passion again seemed to be a necessary, but not sufficient, precondition for success. Some of the less successful students loved what they were doing (and, I hope, will always find it to be a contribution to their life and happiness), but, without exception, every good to great student was on fire with the rage to master their discipline--success was only a road to the next challenge to be conquered.

I think this is harder in trading. Do you really love the process of trading, or are you focused on the financial success and the (very real) change it can make in your life? You don't have to love everything you do, and you might even need to fight the tendency for obsession that comes with passion, but I think your life will be best rewarded if you can bring some coherence. Trading is going to be hard, and it's going to take you at least a few years to have any measurable success. If you don't love it, you probably shouldn't be doing it--that's probably the most important thing of all. Life is short; if you don't love what you're doing, find something you do love.