[dc]M[/dc]uch of my writing here has focused on quantitative tools and ways to look at data. I have called for higher standards and have questioned many of the established tools of technical analysis. I will continue to do that; we’re actually going to dive deeper into some analytical work over the next few weeks, but I wanted to pause first, and think about Art. In the preface to my book, I wrote:

The title of this book is The Art and Science of Technical Analysis. Science deals primarily with elements that are quantifiable and testable. The process of teaching a science usually focuses on the development of a body of knowledge, procedures, and approaches to data—the precise investigation of what is known and knowable. Art is often seen as more subjective and imprecise, but this is not entirely correct. In reality, neither can exist without the other. Science must deal with the philosophical and epistemological issues of the edges of knowledge, and scientific progress depends on inductive leaps as much as logical steps. Art rests on a foundation of tools and techniques that can and should be scientifically quantified, but it also points to another mode of knowing that stands somewhat apart from the usual procedures of logic. The two depend on each other: Science without Art is sterile; Art without Science is soft and incomplete.

There is a time to analyze deeply, and to think through all the twists and turns in the data. Most market participants could benefit from being more structured, more disciplined in their analysis, and could also benefit from asking hard questions about their investment results. But we are traders, not purely scientists. The process of putting on trades, managing risk, and dealing with the outcomes is, for many market participants, a visceral one. Even purely systematic traders will have periods of performance that challenge their convictions, and discretionary traders will find themselves buffeted by every foible and weakness of human nature. To me, Art is where the scientific principles meet application. If you prefer conflict-oriented metaphors for the markets (I did at one time, but I don’t now), Art is what happens on the battlefield. The samurai used to say, cry in the training hall, dance on the battlefield; traders who have done their homework will understand that saying.

I am particularly fascinated by the edges of knowledge–by what can be known, and what we can know about knowledge. These questions have direct application to actual trading. So, over the next few posts we will delve a bit deeper into the Art. We will leave aside the statistics for a bit, and discus behavioral and emotional issues–what happens when actually trade. I will also be talking a bit more directly to the shorter term trader. Why? Because these behavioral issues are often more obvious the shorter our timeframes. The trader holding trades two weeks has a lot of time to prevaricate and justify his actions, but the intraday trader, in an out several times in a single trading session, has to face the reality that a poor entry decision was compounded by an even worse exit, for example. The long-term investor may manage to hold off the day of reckoning forever, saying things like “it’s the market”, “it will come back”, or “I’m not selling at loss because I’m not in this to lose money.” But the same lessons forged in the heat of short-term trading apply to that long-term investor, so if your timeframe is a bit longer, do not be put off by the discussions of shorter term trading.

I am particularly fascinated by the edges of knowledge–by what can be known, and what we can know about knowledge. These questions have direct application to actual trading. So, over the next few posts we will delve a bit deeper into the Art. We will leave aside the statistics for a bit, and discus behavioral and emotional issues–what happens when actually trade. I will also be talking a bit more directly to the shorter term trader. Why? Because these behavioral issues are often more obvious the shorter our timeframes. The trader holding trades two weeks has a lot of time to prevaricate and justify his actions, but the intraday trader, in an out several times in a single trading session, has to face the reality that a poor entry decision was compounded by an even worse exit, for example. The long-term investor may manage to hold off the day of reckoning forever, saying things like “it’s the market”, “it will come back”, or “I’m not selling at loss because I’m not in this to lose money.” But the same lessons forged in the heat of short-term trading apply to that long-term investor, so if your timeframe is a bit longer, do not be put off by the discussions of shorter term trading.

I will leave you with something to think about, in this, one of the traditionally slowest trading weeks of the year: knowledge and understanding of the statistical tendencies of the market define what we can and cannot do in the market. Knowledge of how probabilities “work” help us understand what to expect when we apply trading tools to the market. The question is, how does this knowledge affect what you do? What are you doing that could be better? What are you doing that is illogical and inconsistent? What do you need to change or improve in order to get the most out of the Art of your trading? Tomorrow, we will dig deeper and. hopefully, start to find some answers.

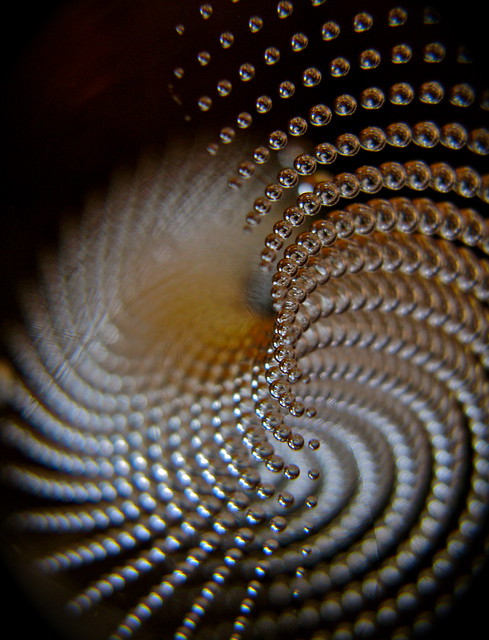

(image credit: https://www.flickr.com/photos/jurvetson/5216518290/)

Good post. I’m looking forward to it!